What is an ICO?

An initial coin offering (ICO) is an unregulated means of crowdfunding . An ICO enables funding of projects through the sale of tokens or crypto-coins, which are similar to shares of a company that are put to public via a regulated IPO, though usually without equity being exchanged.The people who have invested and supported the project can purchase them through an Initial Coin Offering (ICO) transaction with fiat currency (USD or Euro) or cryptocurrencies (like Ethereum). An ICO usually sets a minimum goal for the fundraise and a period of time to reach that goal. If the fund requirements are met within a set timeframe, the money that is raised is used to fund the project and the company can distribute tokens to investors that can be traded on the public cryptocurrency exchanges, like Poloniex or Gemini.

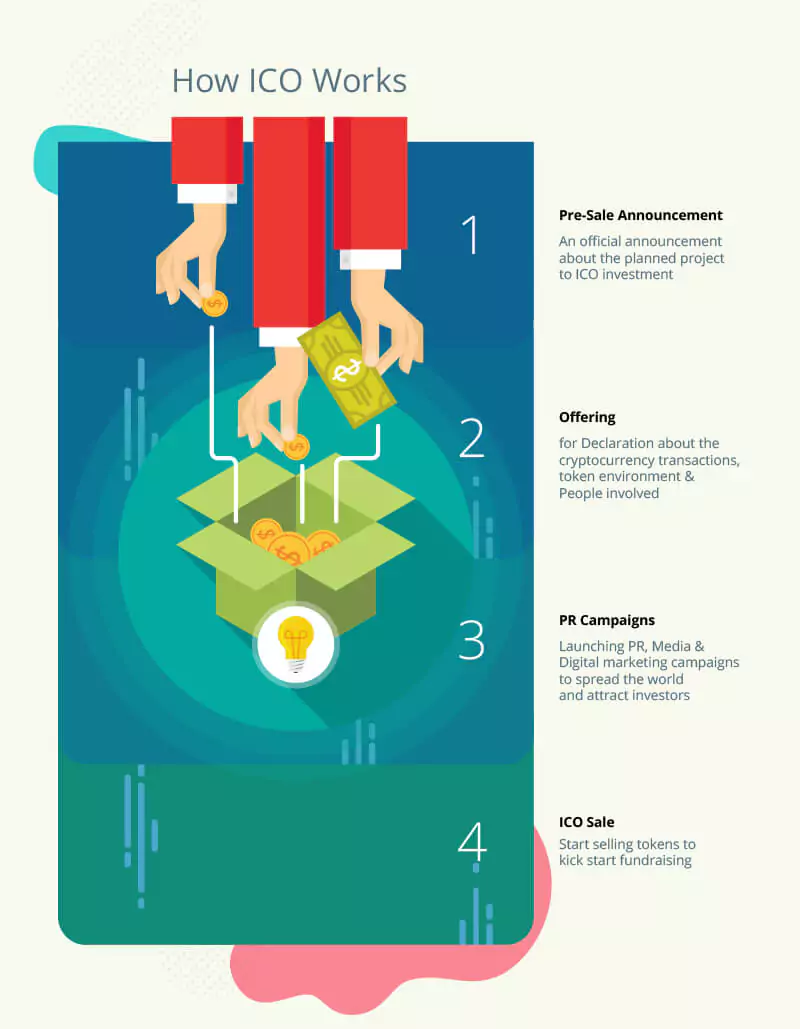

How Does an ICO Work - An Idea is like a virus

IDEA !!. A startup comes up with an idea for a blockchain related project and proposes it to the community.

If the idea finds traction, we go ahead to create a “WhitePaper” that has all the details?—?from the team working behind the project to its technical aspects and future plans.

We decide upon [Token Metrics] the number of tokens that will be distributed, the price of each token and how the tokens will be used in the project’s ecosystem.

Once the white paper is ready it’s time to hit the market, marketing campaigns are launched helps to gain momentum, A Pre ICO, ICO date is made public when the token sale is scheduled to begin. There is usually a defined time period to raise the required funds, after which the sale closes.

Investors then start putting in Money/Crypto and in return receiving their tokens at the end of crowdsale and plans are made for them to go live on exchanges for trading.

Obviously, this is a simplified summary and a lot of work goes behind the scenes, but the outcome is that the startup gets the money to kick off their idea and investors get tokens from a promising startup with the hopes that it will give them future profits.

Jargons Explained

Ethereum: Ethereum is a software program that is an open platform based on the new blockchain technology that helps developers to build and establish decentralized applications. Like Bitcoin, Ethereum is a public distributed blockchain network. Although,there are important technical differences between the two, the most significant distinction is that Bitcoin and Ethereum differ substantially in purpose and capability. Bitcoin gives a peer to peer electronic cash system that enables online Bitcoin payments to one particular application of blockchain technology While the Bitcoin blockchain is used to track ownership of digital currency (bitcoins), the Ethereum blockchain focuses on running the programming code of any decentralized application.

Ether: As explained by ethereum.org “Ether is a necessary element — a fuel — for operating the distributed application platform Ethereum. It is a form of payment made by the clients of the platform to the machines executing the requested operations. To put it another way, ether is the incentive ensuring that developers write quality applications (wasteful code costs more), and that the network remains healthy (people are compensated for their contributed resources).”

Smart Contract: Smart contract is a program that when an asset or currency transferred into the program and it runs this code, at some point it automatically validates a condition and also determines whether the asset should go to another individual or back to the other person involved, or whether it should be immediately refunded to the person who sent it or some other. Parallelly, the decentralized ledger stores and replicates this document, and gives it a certain security and immutability. Smart contracts basically works on the basis of the IFTTT logic also known as the IF-THIS-THEN-THAT logic.

Token: Tokens represent any “ASSET”, It can be a currency, a promise for a product in a crowdfund, an insurance policy even a ticket to an event. Majourly tokens can fall under two categories.

Utility Tokens: Companies issue “utility tokens” which are essentially digital coupons giving investors access to the features of a particular project starting at a later date. Tokens do not grant ownership, but they can be traded providing fast liquidity to who want it on the open market.

Securities: In contrast to utility tokens, some ICOs are already being done as registered securities offerings. Most ICOs, avoid being considered as a security because of the mandatory regulations, but many see a bright future with ICOs been categorized as registered securities. This means the token offering may include equity or some form of an investment return.

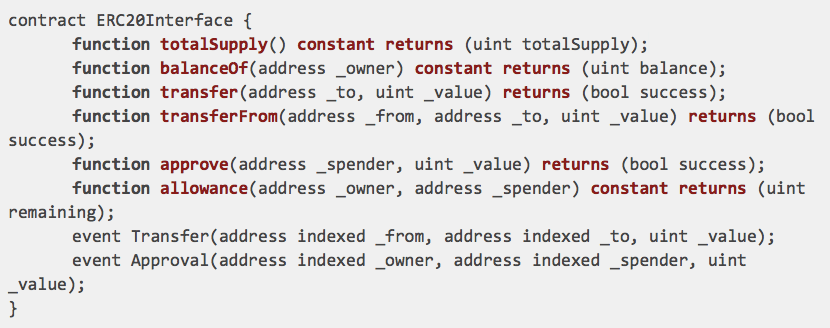

ERC20 Token: ERC20 is a technical standard used for smart contracts on the Ethereum blockchain for implementing tokens. ERC20 compliant tokens all have the same functions, with the same names, that take the same arguments. You can create a token in the exchange system that allows you to quickly add new tokens to your platform the moment they are released, as long as they follow the ERC20 standard. There can be a number of tokens, the same system can support trading between Token A and B, A and C, A and Z, Z and M etc. The end result is of a less risk, more uniformity, reduced complexity, and enhanced liquidity of tokens. A successful ICO can be carried out with their ERC20 tokens being traded on exchanges without the communication among themselves and the exchange developers. ERC20 provides for a positive feedback loop, so that token purchasers can be more certain that they can trade new ICO tokens, and they can purchase more ICO tokens, causing more ICO’s to be created, and ultimately more innovation and value to the Ethereum blockchain.

ERC20 Interface

PRE-Sales: The process of pre-sales are to help the company or Blog/leadership raise the funds necessary to prepare for the launch of the their public ICO and/or to get some more of the product/ service finished before the launch.. The pre-sales will typically give a bonus for contributing during the period since your funds will be locked up earlier and, as an investor, there is a big risk you are taking on them because you had invested earlier. Another reason companies will do an ICO pre-sale is to get private Venture Capital money in at a bigger discount than public funds.

Why think of KYC and AML for an ICO?

The KYC or AML process is now standard practice for any legitimate ICO looking to raise funds. These processes not only benefit the project implementing them ,but also help to protect those with interests within the project.

This process of KYC or AML helps to sift out those who have no real interest in the success of the project but are simply using this as a means to clean out their dirty money by dumping into ICOs It’s an easy way for criminals to launder their money, making it hard to trace its true origins.

Following are some of the benefits for incorporating KYC/AML while going for an ICO

- We set a credibility factor with Banks and payment gateways.

- Viewing tokens as securities for future, so create a strong base now.

- Prolonged legitimacy, even by giving added advantages.

- Gain Trust from investor by filtering out non interested member out.

- Be future ready we never know when the next financial policy comes in and not maintaining enough informations is leading us to pay regulatory fines.

Conclusion: You know your idea is great and with a great team you can definitely make the next great thing. All you lack is finance, people are out their to help with. ICO is what makes these dreamers makes their dreams come true. The only thing is “Know what you are building” and “Build it with a team that knows in and out of it …”